The Payroll Blog

News, tips, and advice for small business owners

- Home

- Calculating Payroll Taxes 101

Calculating Payroll Taxes 101

Hiring employees for your small business for the first time is an exciting process. It allows you to build a team, grow your business, and plan your business goals.

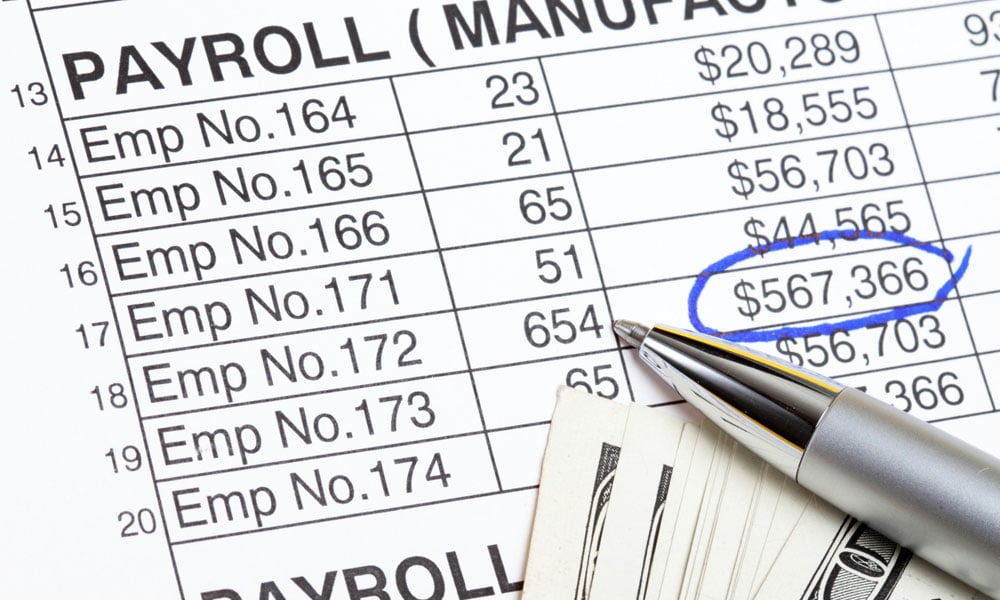

However, that initial excitement is followed by some other tasks that might not be as exciting. Employees require paychecks, which means as a small business owner, you’re now tasked with calculating payroll taxes and paying employees accurately and on time. If you plan on a DIY payroll approach, you’ll need the 4-1-1 on payroll taxes.

Payroll Taxes 101

There are many different components to payroll taxes. Payroll taxes include federal, state, and local taxes that need to be withheld from employee paychecks. These rates can change annually, so for the most accurate info for the year, you’ll want to check in with the IRS, and applicable state and local agencies, to ensure you are remaining compliant. Payroll taxes are also often represented as acronyms, which we will break down below.

FICA

Part of your payroll tax calculations includes accounting for Social Security and Medicare taxes. These taxes fall under The Federal Insurance Contributions Act or more commonly known as FICA taxes. According to the IRS, as a small business owner, you are required to withhold 6.2% for social security and 1.45% for Medicare. Your employees will be contributing the same amount, for a total of 12.4% towards social security and 2.9% for Medicare.

Unemployment Taxes

The Federal Unemployment Tax Act, or FUTA, requires employers to contribute to the federal unemployment pool. According to the IRS, under the general test, you are required to pay FUTA taxes if:

- You paid wages of $1,500 or more to employees in any calendar quarter

- You had one or more employees for at least some part of a day in any 20 or more different weeks. This includes all full-time, part-time, and temporary workers.

For those required to pay FUTA taxes, the tax rate is 6.0% and is applied to the first $7,000 of employee wages. Any wages earned after the $7,000 base wage will exempt from any other FUTA taxes.

You also need to be aware of the State Unemployment Tax Act (SUTA). SUTA taxes may also be referred to as state unemployment insurance (SUI), or reemployment tax. Your state is responsible for setting these rates so you’ll need to check in with your state specifically for guidelines, and make sure you’re adjusting your contributions accordingly.

Income Taxes

Income taxes are another part of payroll taxes that will vary based on state. When filing personal tax returns, the majority of people will file for federal and state income taxes. However, several states do not require income taxes to be withheld.

Forms Associated with Payroll Taxes

Forms go hand in hand with calculating payroll taxes. Whether these are forms that will need to be completed by employees as part of onboarding paperwork or forms that you’ll use come tax season, you’ll want to know about them prior to starting your payroll tax journey so you know what to expect and don’t miss deadlines.

Form W-4

Form W-4 is a key form you’ll need each employee to fill out. When completing the form, employees provide important information regarding their personal financial situation, which allows you to figure out what needs to be withheld from their paychecks. Your job as a small business owner is to withhold the correct amount as this will affect your employees come tax season. It’s important that employees review Form W-4 every year because withholding can change based on life events like getting married or having children. Additionally, Form W-4 will be what you use to produce Form W-2 for tax season so you need to ensure basic information like address and name (if they got married) are accurate.

Form W-2

As a small business owner, you are responsible for distributing Form W-2 to employees by January 31st each year so they can file their personal taxes. Form W-2 shows employees how much they contributed to payroll taxes throughout the year based on their withholding status. When employees withhold too much, they will generally receive a tax refund, while others who don’t withhold as much may end up owing additional taxes. Based on their results, your employees may want to update their Form W-4 for the next year.

Form 940

You will be required to use Form 940 to report your annual FUTA tax contributions. Some good news: if you pay your State Unemployment taxes on time, you’ll qualify for a FUTA tax credit up to 5.4%, which means your total FUTA contribution could be 0.6%.

Form 941

You’ll use Form 941 to report income taxes, social security tax, and Medicare tax withheld from employee’s paychecks.

How to Calculate Payroll Taxes

Now that you know everything that goes into payroll taxes, you have one final step: calculating them for each paycheck. Thankfully, there are plenty of resources online that you can use, including payroll tax calculators that will guide you through the process so you are accurately withholding and calculating the correct amount.

Alternatively, if you think this is a lot to manage and would rather focus your attention on other aspects of your business you are more passionate about, there are several places you can turn for help. An accountant or bookkeeper are great options because they can also help with other financial tasks outside of calculating payroll taxes, like financial planning. Another option would be choosing an online payroll service to keep you compliant and ensure that your employees are paid accurately and on time. I

Bottom Line

Payroll and taxes probably weren’t at the top of your list when starting your small business journey, but for businesses with employees, they are necessary. If you plan to stick with the DIY payroll path, ensure that you’re leaving yourself plenty of time to research all federal, state, and local tax laws and time to dedicate to running payroll. As with anything, the more you do it, and the more you know about it, the easier the process will get and soon, you’ll be a payroll tax professional.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.