The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- Exempt vs. Non-Exempt: Small Business Employee Classifications Are Not Created Equal

Exempt vs. Non-Exempt: Small Business Employee Classifications Are Not Created Equal

Bringing a new employee into your company can be a big step. As a small business, each new employee is not only a testament to the success and potential of your business, but a significant investment of time and monetary resources.

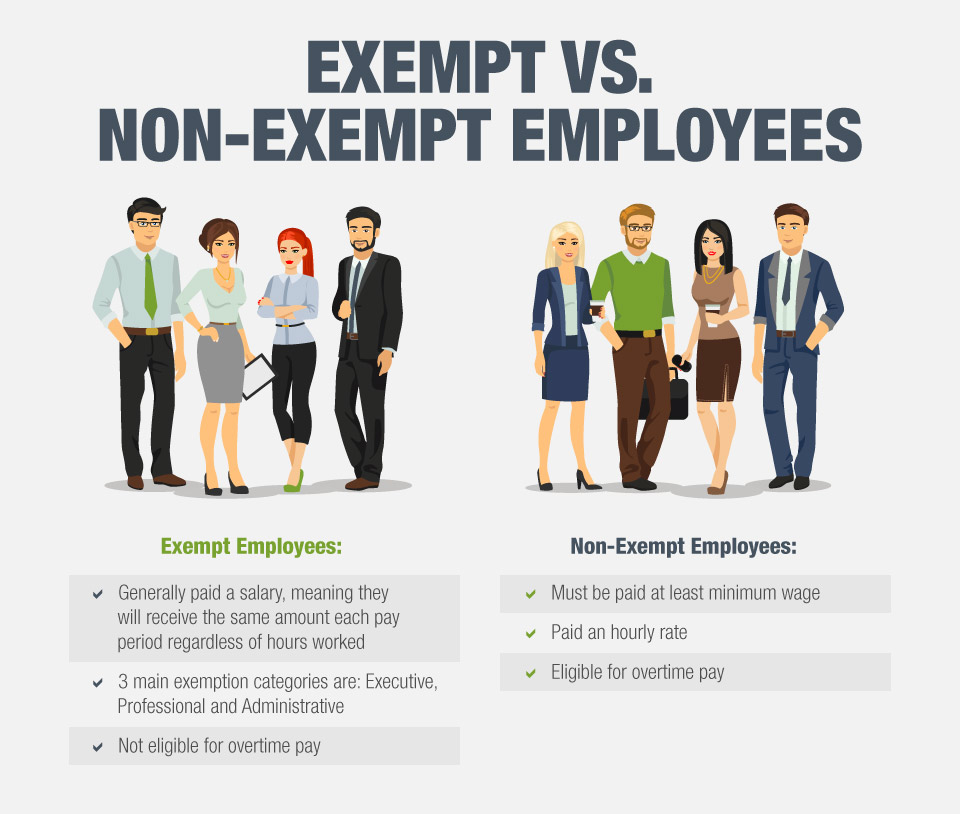

From a payroll perspective, you'll need to understand both types of employee classifications. Let's examine some of the characteristics of each.

What It Means to Be an Exempt Employee

- At the federal level, overtime eligibility is determined by regulations which are part of the Fair Labor Standards Act (FLSA). "Exempt" employees are those deemed exempt from some of the FLSA provisions, including requirements for minimum wage and overtime pay.

- The broadest category of exempt employees falls under "white-collar exemptions" for administrative, executive, and professional employees, computer professionals, and outside sales employees.

- Exempt employees are generally paid on a salary basis, that is, they receive the same amount of pay each pay period regardless of the quality or quantity of work performed. They are not eligible to receive overtime pay for hours worked over 40 in a workweek.

It's important to note that the exemptions from overtime requirements under the FSLA are based on the specific job duties as well as the basis of pay for the position.

What It Means to Be a Non-Exempt Employee

- Non-exempt employees must be paid minimum wage for all hours worked as well as overtime pay at a rate of one and one-half times their regular rate of pay for those hours worked over 40 in a workweek.

- Different states and localities may have stricter policies relating to the calculation of overtime pay.

- Under the FLSA, employees need only to pay non-exempt employees for time worked. For example, employers are not required to provide a different pay rate for holidays and are not required to pay non-exempt employees who do not work a holiday—unless there is an applicable state/local law or employment contract dictating a different rate of pay or paid holiday policy.

- Non-exempt employee classifications do often mean more work for you as the business owner and the person managing payroll. Why? Because you'll need to be tracking the hours worked by your non-exempt employees, and potentially calculate multiple pay rates per employee for a given pay period.

The Bottom Line

The difference between exempt and non-exempt employees usually comes down to hourly and salaried classifications and the eligibility for overtime pay. From a payroll perspective, it's important to understand the differences between exempt and non-exempt employees, including the guidelines for proper classification. This can help you with everything from making hiring decisions to running payroll.

If you are using additional payroll services, such as a bookkeeper, accountant, or online payroll provider, you'll want to make sure that they can support the payroll requirements of your business. For non-exempt employees, for example, you will want to ask about timesheet software integrations and multiple pay rate support.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.