The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- How Do I Choose a Legal Structure for My Small Business?

How Do I Choose a Legal Structure for My Small Business?

When starting a small business, there are many things that you are going to have to consider and important decisions you’ll have to make in order to get your business up and running. One of these decisions that you won’t want to take lightly is choosing a legal structure. As a small business owner, there are several options to choose from, with pros and cons for each depending on your business goals.

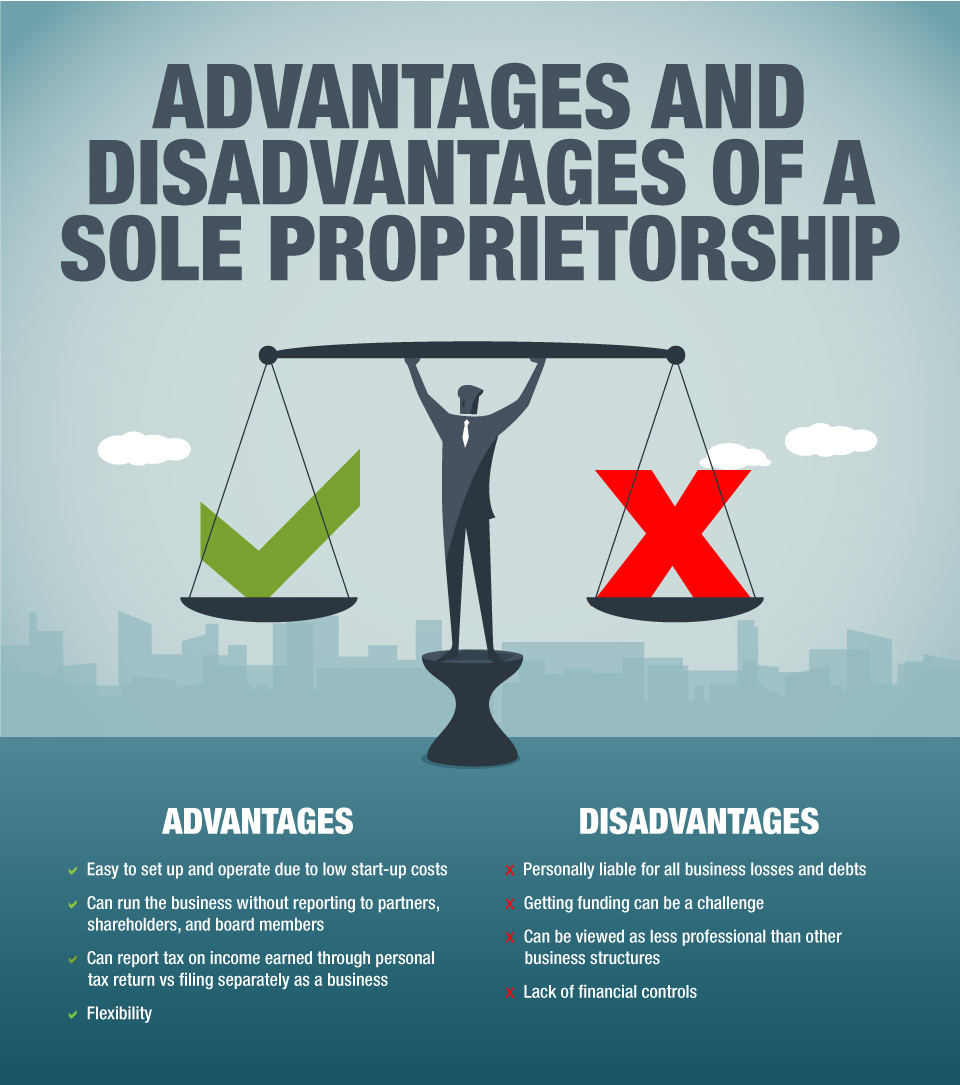

Sole Proprietorship

According to the U.S. Small Business Administration, “over 70 percent of U.S. businesses are owned and operated by sole proprietors or sole traders”. There are many reasons that make a sole proprietorship the most popular choice for small business owners, however, being the easiest business structure to set up likely makes that decision easier to make.

Corporations

If you’re worried about the liability issues, a corporation could be the way to go. A corporation is an independent legal entity. This means that the business will be separate from the owner. The most important aspect of a corporation is limited liability. This means that shareholders are able to take part in the profits through dividends and stock appreciation, but they aren’t responsible for the company’s debts. There are various types of corporations so you’ll want to evaluate each before making a decision.

C-Corp

A C-Corp is the most popular type of corporation.

- Owners, or shareholders, are taxed separately from the entity

- Taxes on profits from the business are at corporate AND personal levels which means there is double taxation

- To form a C-Corp you have to start by registering a business name. From there you need to obtain an employer identification number (EIN)

- A meeting must be held once a year for shareholders and directors

- Personal liability is limited for directors, shareholders, employees, and officers meaning legal obligations of the business won’t become personal debt obligations

S-Corp

A Subchapter S, commonly shortened to S-Corp allows corporations to pass income directly to shareholders to avoid the double taxation that is experienced in C-Corp’s.

- Shareholders will report income and losses on individual tax returns

- S-Corp’s do not pay federal taxes at the entity’s level, which helps save money

- Heavy IRS scrutiny because of how S-Corp’s pay their employees

Limited Liability Corporation (LLC)

Members of the company are not personally liable for the company’s debts or liabilities under an LLC. An LLC is hybrid entities that have characteristics of corporations, partnerships or sole proprietorships.

- LLC’s help limit principals’ personal liability

- An LLC is easier to set up compared to a corporation and it provides more flexibility with protection

- State laws specify whether an LLC has to be dissolved upon death or bankruptcy of a member

- May not be the best option if the founder’s objective is to become a publicly listed company

Partnership

If you decide to go into business with others, you may want to think about a general or limited partnership.

General Partnership

- The most common type of partnership

- Each partner has the authority to make business decisions

- All partners must agree to liability

- Tends to have low set-up costs and less paperwork when setting up

Limited Partnership

- One or more partners are liable only to the extent of the money that the partner has invested

- Limited partners do not receive dividends but receive direct access to the flow of income and expenses

- The biggest advantage is that owners are typically not liable for company debts

- Partners must register the venture in their state and have all necessary permits and licenses ready for starting up a partnership

Joint Venture

- Two or more businesses come together

- Usually formed to combine resources, combine expertise, or to save money

- Usually creates a separate business entity that owners contribute assets to

- Parties in the joint venture share management, profits, and losses

Bottom Line

There are a variety of pros and cons depending on the business structure you choose for your small business. According to the U.S. Small Business Association, you can change your business structure if you decide the current structure isn’t working for you. Typically, business owners change when the needs of their business changes. You’ll just want to know which steps to follow and be aware of all differences with your new business structure.

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.