The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- How Do I Get an EIN Number?

How Do I Get an EIN Number?

A Federal Employer Identification Number (FEIN), also known as an Employer Identification Number (EIN), is used to identify a business entity. While not always the case, most companies need an FEIN to conduct business.

The IRS makes it simple to apply for and obtain an EIN. Your options for doing so include:

- Online

- Fax

- Telephone

Note: obtaining an EIN through the IRS is free. For this reason, there is no need to pay another party for the service.

Apply Online to Get Started

Despite the fact that there are many ways to apply for an EIN, the preferred method is online. The internet application is simple to understand, easy to follow, and above all else, the quickest way to obtain your number.

Once the application is complete and your information is validated, the IRS can issue an EIN on the spot.

Note: you can begin the online application by visiting this page of the IRS website.

Do You Need a FEIN?

Are you on the fence regarding whether or not to apply for an EIN? If so, the IRS has you covered. If you answer "yes" to any of the following questions, you will need an EIN:

- Do you have employees?

- Do you operate your business as a corporation or a partnership?

- Do you withhold taxes on income, other than wages, paid to a non-resident alien?

- Do you file any of these tax returns: Employment, Alcohol, Tobacco, Firearms, or Excise?

- Do you have a Keogh plan?

You must also have a number if you are involved with any of these types of organizations:

- Non-profit organizations

- Plan administrators

- Farmers' cooperatives

- Real estate mortgage investment conduits

- Estates

- Trusts

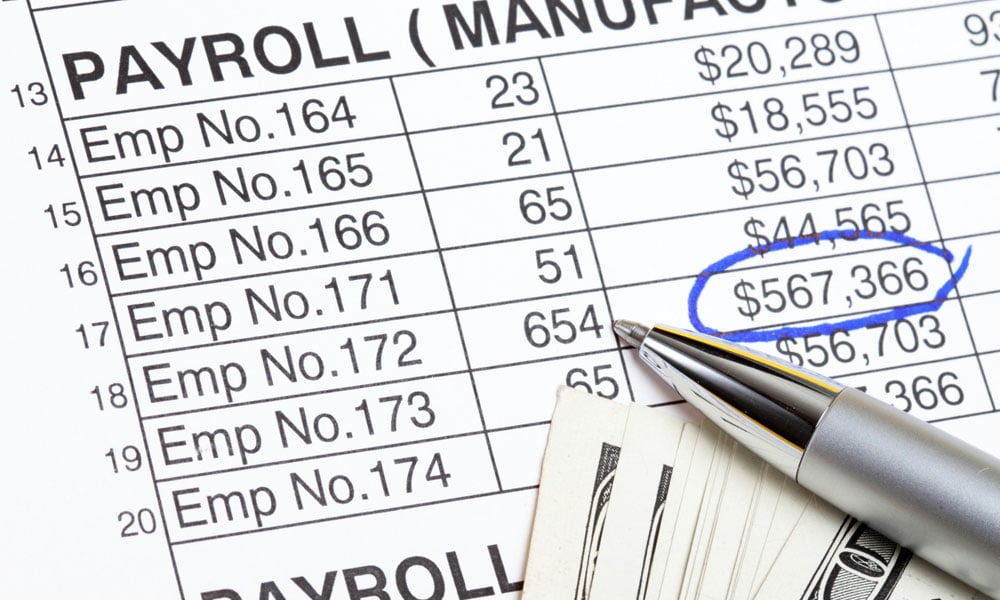

FEIN to Run Payroll

If you are a one-person company with no responsibility of paying others, you may be able to get away with running your business as a sole proprietor (and no EIN). However, if you need to run payroll at any time, an EIN is required. Without this, you are unable to move forward with the payroll process, thus you have no way of legally paying employees.

Don't Delay

There is a lot that goes into starting a business, but obtaining a Federal EIN is one of the first things you should do. You will need this for everything from opening a bank account to paying taxes to running payroll.

If you have any questions regarding how to obtain an EIN, your tax professional or the IRS can provide assistance. However, you may be able to get an EIN on your own, so you're ready to start your new business.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.