The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- How to Withhold Payroll Taxes for Your Small Business

How to Withhold Payroll Taxes for Your Small Business

All business owners must withhold payroll taxes. It’s just a fact. You’re legally obligated to do it, so payroll taxes are something you really can’t afford to hide under the filing cabinet, risking fines and penalties.

Fines and penalties come in the form of an additional tax added to the amount due and can range from two percent to 15 percent each month the return is late, according to IRS Publication 15.

So, what are the payroll taxes and how do you go about paying them?

Let's walk through some of the basics on the federal income tax, Medicare and Social Security taxes, and with state and local taxes.

Federal Income Tax

The federal income tax is applied to all forms of earnings that make up an employee's taxable income. The actual income tax withheld on wages is based on the total wages after subtracting declared allowances (often referred to as deductions or exemptions). The IRS has several ways to calculate income tax withholding for your employees including the Wage Bracket Method, Percentage Method along with alternative methods. In general, the withholding depends on the tax bracket, marital status and number of allowances claimed on Form W-4.

Medicare and Social Security Taxes

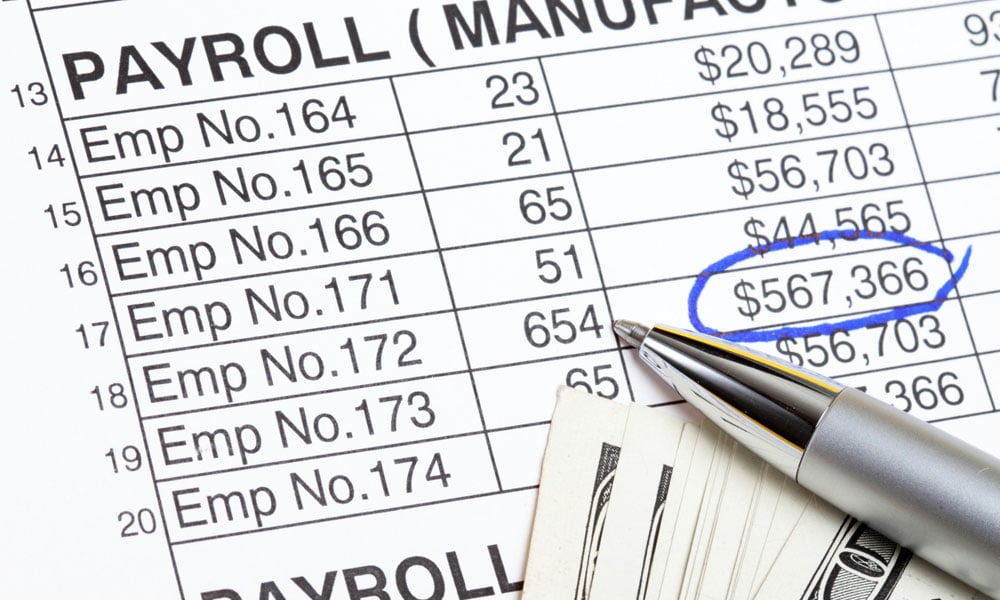

Together these taxes are known as FICA or Federal Insurance Contributions Act. Both the employer and employee pay a portion of the FICA tax. As the employer, you are responsible for withholding the proper amounts. Here are the details:

Social Security - The current withholding rate for Social Security from employee pay is 6.2 percent and 6.2 percent for the employer, totaling 12.4 percent. There is a cap on the amount of Social Security taxes paid. The wage base limit for Social Security in 2018 is $128,400 ($7,960.80 max.), which represents the maximum wage that is subject to the tax.

Medicare - The current tax rate is 1.45 percent for Medicare, which is matched by the employer with an additional 1.45 percent. Although Social Security taxes are capped, no such cap exists for Medicare. An additional Medicare tax of 0.9 percent is added for those earning generally $200,000 or more depending on marital status. There is no employer match required for the additional Medicare tax.

As a small business owner, you must file Form 941, Employer's Quarterly Federal Tax Return, each quarter if you withhold federal income tax or Social Security and Medicare taxes.

State and Local Taxes

State and local taxes vary widely. There's a state income tax in 43 states. Exclusions include Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. Many localities have income taxes and also require withholding. Local taxes are typically based on city, school district or county. You'll need to contact your local and state governments to find out if a tax applies and what amount you need to withhold.

Where and When to Deposit

The IRS has two deposit schedules: monthly and semi-monthly. These determine when you deposit Social Security, Medicare and income taxes. Your deposit schedule is based on your total tax liability reported on Form 941.

When it comes time to deposit the federal income tax along with the employer and employee portion of the Social Security and Medicare taxes, you'll generally use the Electronic Federal Tax Payment System (EFTPS). There are exceptions, so be sure to check Publication 15.

Don't forget about the unemployment taxes. It's important to note that these are not withheld from employees. Federal unemployment tax and the state unemployment tax operate under guidance of the Federal Unemployment Tax Act (FUTA). The federal and state unemployment taxes are paid by the employer (not the employee) with the exception of New Jersey, Pennsylvania and Alaska.

As you can see, payroll tax withholding can get complicated. For help in calculating these taxes, feel free to use our business calculators. These are for guidance only—not running payroll—but can help point you in the right direction.

Note: This article was updated with current information on March 14, 2018

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.