The Payroll Blog

News, tips, and advice for small business owners

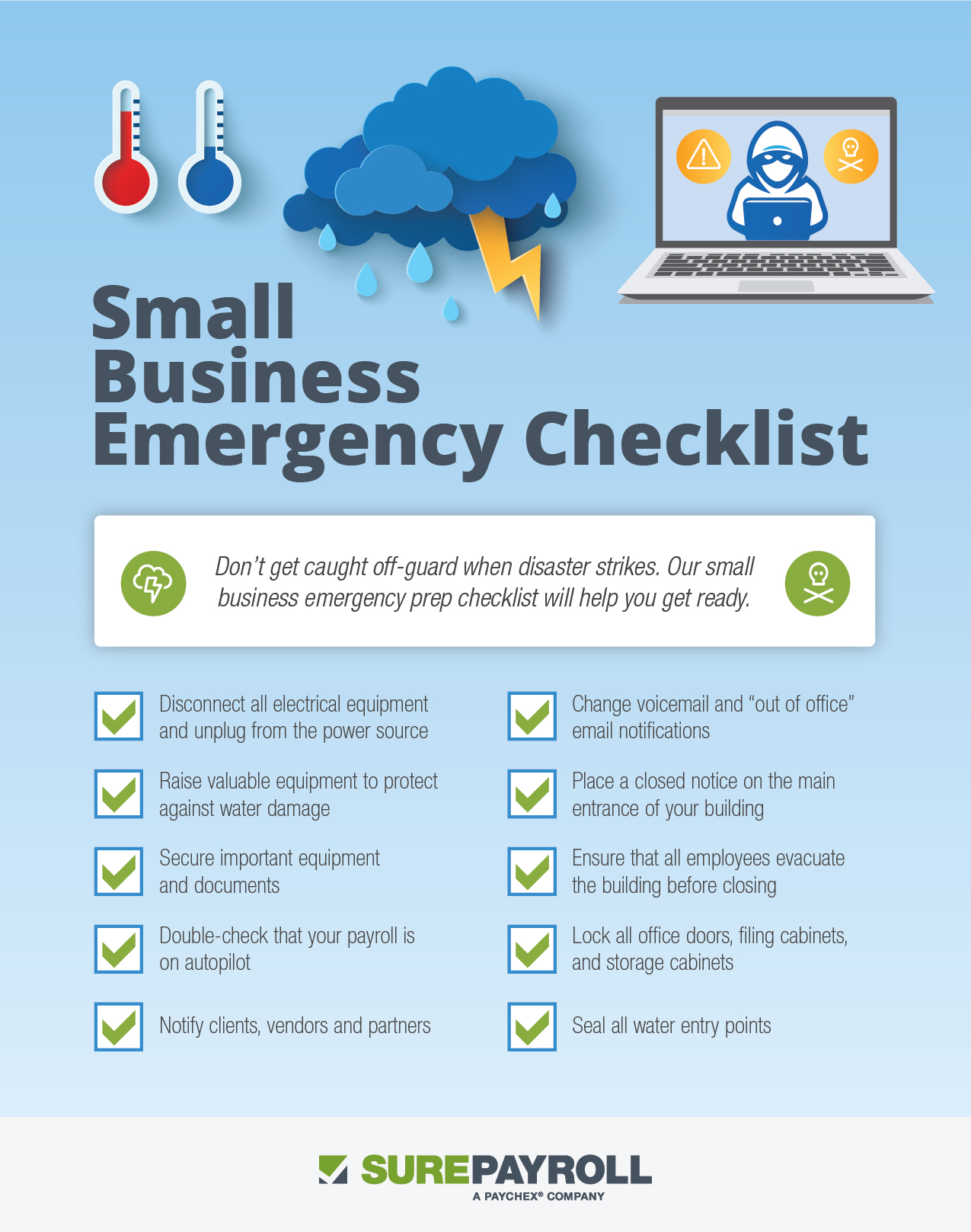

Can Your Small Business Weather an Emergency? 7 Tips to Prepare for a Crisis

Regardless of how established, unique, or successful a business, there’s always a chance an unexpected external event could ice operations. Defining a contingency plan for a variety of emergency scenarios is a critical task for business owners.

Fires. Cyberattacks. Vandalism. Weather events. Utility service interruption. Supply chain disruptions. And more.

A variety of external events put small business operations at risk. Whether brief or extended, any service interruption is a threat to the bottom line, or the very existence of a small business. Cash-flow quickly slows while bills rapidly build when an external event halts business-as-usual.

Small businesses don’t always have the cash reserves or credit line to keep them solvent when disaster strikes. The key to surviving any service interruption is to understand vulnerabilities and build and test a risk mitigation strategy before the emergency.

Consider these seven tips to build an emergency preparedness plan and a post-emergency business continuity plan to help minimize losses and maximize recovery.

1. List Your Risks

Gather your employees and take time to brainstorm every scenario that could impact your business, and a series of steps to mitigate the impact from each. Discuss how likely each type of emergency will occur and the ramifications to your business following the event. For example, a business built in a flood plain of a major river has a higher risk than a one built on a mountain top. At the same time, the threat from cyberattacks is relatively the same for any business. Consulting with insurance, cybersecurity and other trusted advisors can help you better understand your risk for any emergency and take steps to protect your business and employees through prevention strategies. While prevention strategies my incur some added cost on the front-end, they can minimize or eliminate large losses long-term.

2. Employee Safety

Employee safety is an important consideration for every business owner and helps remind employees they are valued and a priority.

Regularly refresh evacuation plans based on employee input. Take time to clearly define roles and responsibilities and rehearse emergency plans so everyone is well-versed on proper procedures. Provide every employee with emergency numbers for local fire and police, and for other employees. Provide key employees with contact information for VIP customers, suppliers, vendors, and other key stakeholders.

Be sure to consider employee well-being post-emergency. Create a check-in process to keep employees informed on next steps and provide them with access to resources they may need on a personal level, like the business employee assistance hotline.

3. Customer Safety

Customer safety should also be a priority for every business. Even the smallest thing can pose a safety hazard and put your business and livelihood at risk. Slips, trips, and falls are a large portion of the injuries that are reported by customers each year. Keep aisles and walkways clear, mop spills, use antiskid mats and improve lighting and ventilation systems are ways to reduce risk. An appropriate fire suppression / sprinkler system consistent with local and state building codes will keep customers and employees safe, prevent loss of inventory or equipment, and potentially reduce insurance costs.

In addition, effective cybersecurity systems are necessary to keep customer information like bank accounts and credit card data safe from cyber criminals. If a data-breach does occur, contact your customers immediately so they can take necessary steps to limit any damage.

4. Security

Security for small businesses formerly meant locking doors when closed and perhaps installing an alarm system. While still important, cybersecurity is equally as important. Theft of digital information has become the most reported fraud, surpassing physical theft. With the internet creating opportunity for businesses of all sizes and from any location to reach global markets and work efficiently by using computer-based tools, cybersecurity must be part of emergency planning.

The World Economic Forum cites internet and computer-based criminal activities as one of the most serious challenges facing the modern world, and some cybersecurity reports suggest that cybercrime is among the fastest rising crime in the US and across the world. The cost of global cybercrime damage in 2021 is $11 million per minute. The Federal Communications Commission (FCC) has tips to keep your small business “cyber-safe.” In addition, the Global Cyber Alliance (GCB) has a toolkit for small businesses with free resources to lower your cyber risk.

5. Insurance

While often viewed as a costly necessity to be kept as low as possible, insurance is a risk management tool critical for all businesses. It can reduce the financial impact of accidents, fires, and other unplanned disruptions. It protects businesses from events out of their control and improves chances for survival. Review your coverage with your carrier and design an insurance program that fits your business and risks. They may even be able to call out unnecessary risks that will pre-empt a disaster from happening, which is in their best interest as well. If disaster strikes, file a claim as soon as possible.

6. Infrastructure

Your business infrastructure consists of the actual physical building, as well as utilities like electricity, gas and water. Keeping your building in good shape will keep minor annoyances like a leaky roof or damaged windows from becoming major issues during storms or natural disasters. Preventing water from entering the structure is critical. Water damage can cause long disruptions while repairs are made. Schedule regular infrastructure to spot problems before they occur. Again, your insurance carrier can provide resources to identify issues and plans to rectify problems. That can help lower rates overall.

7. Business Continuity

Business continuity planning involves developing a practical plan for how your business can prepare for and continue to operate after an incident or crisis. A business continuity plan will help you to:

- identify and prevent or reduce risks where possible

- prepare for risks that you can't control

- respond and recover if an incident or crisis occurs

Preparing a business continuity plan will help your business recover more effectively if an incident does happen. While a small business owner may not be able to predict what situations could threaten operations, it is possible to anticipate most scenarios and plan accordingly. To get the most out of a business continuity plan, schedule and regularly test and update it, making sure you account for any changes to your business, your industry, or your location.

While it’s not possible to plan for every eventuality, it is possible to mitigate risk and recovery quickly in the event of an emergency event through a disciplined approach to prevention, preparation, and practice.

Related Links:

US Chamber of Commerce Small Business Guide to Disaster Preparedness

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.