The Payroll Blog

News, tips, and advice for small business owners

Social Media Marketing Tips for Small Business Owners: The Do’s and Dont's

Having a strong presence on social media has become a necessity when it comes to growing your small business, but posting online comes with a few caveats. To ensure you make the most out of your social media marketing opportunities (while also avoiding costly social media mistakes), check out our tips for social media marketing for small business below.

Did you know that 77.6% of small business owners use social media to promote their brand? And that almost 90% of those small businesses believed they received increased exposure and traffic due to their efforts on social media?

Stats like these show why social media marketing is more important than ever before, but with so many different platforms (and different types of content) in existence, many entrepreneurs are left feeling overwhelmed when it comes to using social media for business.

Thankfully, social media marketing isn’t as complicated as it seems, and gaining exposure on platforms like TikTok and Facebook may be easier than you think. Just follow our social media marketing tips below to learn what you should – and shouldn’t – do online as a small business owner.

Social Media Marketing for Small Business DO’S

- Use Video: Videos appeal to 85% of US internet users and get 48% more views on social media in comparison to other types of posts.

- Use YouTube: YouTube is the most-preferred video-sharing platform for nearly 9 in 10 marketers—even over TikTok.

- Mix Things Up: Since both the Instagram and Facebook algorithms prioritize diverse content, it’s important to vary what you post. This can include formatting diversity (i.e. alternating between posting GIF and JPG images) as well as taking advantage of the various formats offered by certain platforms (such as going Live or using Reels).

- Encourage Interactions: Asking questions on Facebook to encourage interactions on posts is a healthy way to get a boost from the algorithm. You can also use Twitter polls and interactive stickers on Instagram Stories.

- Promote User-Generated Content (UGC): Using user-generated content, or content that’s been created by your customers (i.e. a review video) can help you appear more authentic and gain the trust of viewers. Promoting contests, reviews or testimonials, Q&A sessions, quizzes, and branded hashtags are ways to invite UGC.

- Plan the Timing of Posts: The time and effort that goes into making original content should not go to waste by posting during off-peak times. There are premium times of day or specific days of the week that have a higher chance of being seen, so be sure to plan your posts accordingly.

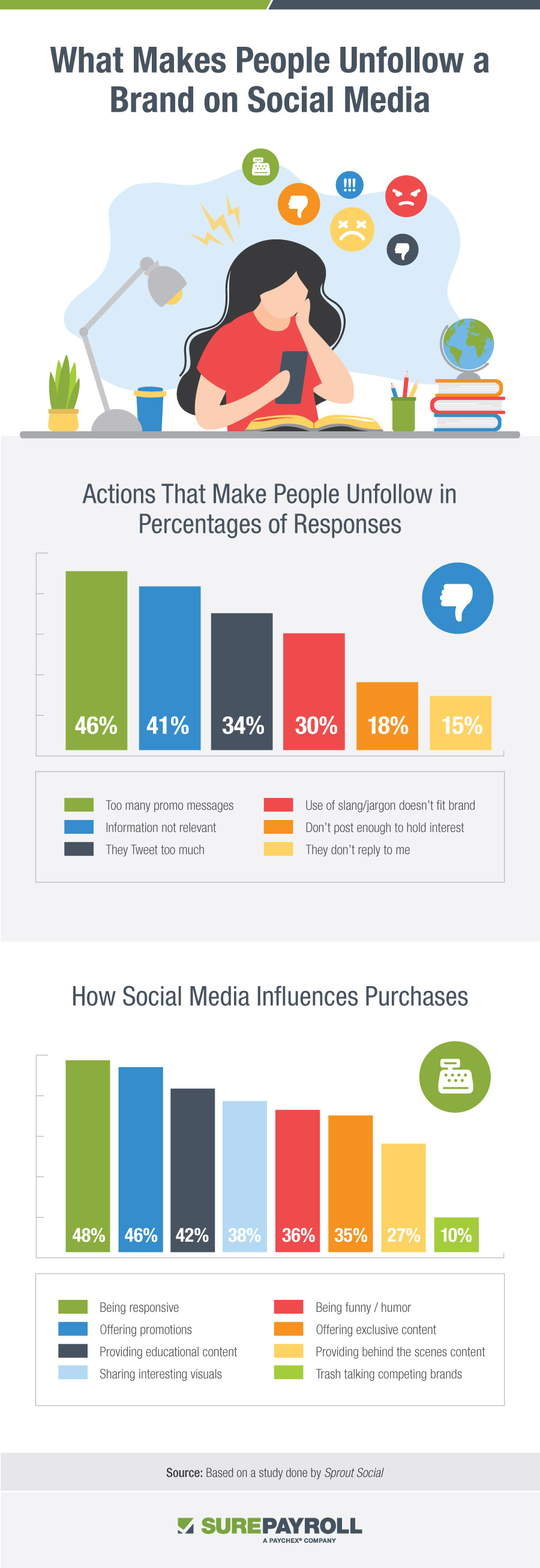

- Be Responsive: Being a responsive company can drive consumer purchases—even more than offering promotions or discounts. Opening communication lines with customers should include responding to customer messages, comments, reviews, and tags as much as possible.

- Carelessly Choose Platforms: Make sure to post the right content on the right website – And prepare for a different response on each. For example, Twitter contains more negativity than platforms like Facebook and Instagram, so be aware of your audience.

Social Media Marketing for Small Business DON’TS

- Post Too Often: Posting excessively can lead to negative impressions, associating your brand with spam, or even unfollowing your business on social media.

- Obviously Over-Process Content: Not all video or image content posts have to be perfectly staged, which is especially true for 90% of millennials who prefer more informal posts that appear more real over heavily edited ones. (Aerie, for example, stopped photoshopping their models in 2014, and have experienced a direct increase in sales ever since.)

- Rely Heavily on Influencer Marketing: Paying for promotions and reviews isn’t always a bad thing, but it has the potential to erode customer trust – especially when you aren’t honest about it. 61% of people feel like brands aren’t transparent enough about their use of influencer marketing, meaning they think it’s unclear whether certain influencer posts are sponsored or authentic.

- Try Too Hard to be “Hip”: Whether you’re participating in a TikTok trend that was popular last year or making a Facebook post with outdated slang, viewers can tell when a brand is trying too hard to be cool – And it’s not well received.

- Get Too Political: Because Facebook has gotten in trouble for (unintentionally) prioritizing polarizing and controversial content in the past, the current algorithm may penalize brands who regularly post about controversial topics. Therefore, it’s best to avoid political debates on your professional pages.

- Exclusively Self-Promote: Promoting your brand or your product in every single post can come off as shameless. Consider occasionally sharing current events, entertaining content, or educational resources that relate to your brand or industry, too.

With more than 4.2 billion users across the globe, social media is an amazing (and easy!) way to gain exposure, build your business, and increase your leads – All without having to pay a single cent. So regardless of what type of business you own or what type of goals you want to achieve, start taking your social media marketing seriously! Make a plan, make a profile, and start following our tips on social media marketing today.

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.