The Payroll Blog

News, tips, and advice for small business owners

Tax preparation spikes anxiety among Americans, new survey shows

Changing tax laws combined with reduced or expiring tax credits increase the stress, anxiety and headaches Americans feel about this tax preparation season as many wonder if they will owe or get a refund this year.

The IRS is predicting taxpayers will receive significantly smaller refunds compared to last year as tax credits return to 2019 levels. Taxpayers will feel the impact as amounts for the Earned Income Tax Credit (EITC ), the Child Tax Credit (CTC) and the Child and Dependent Care Credit revert to pre-COVID levels. Plus, taxpayers who do not itemize cannot deduct charitable contributions like they could last year, according to the IRS.

It’s no wonder nearly half of Americans report getting a headache just thinking about their taxes, according to a recent survey commissioned by SurePayroll. The survey of 2,000 adults, including 500 CPAs and bookkeepers, found that the most stressful parts of the tax process are gathering the necessary information (40%), waiting for employer documents (33%) and concerns about owing the IRS (27%).

“Starting tax prep well before April pays big returns for businesses and individuals when it comes to reducing stress,” said Marcus O’Malley, SurePayroll CPA / Reseller product lead. “As you are waiting for documents from employers and financial institutions, you can organize the information and papers you do have, like charitable contributions and medical receipts. Then, you’ll have everything ready to go when you have all your documents in hand.”

Even in the face of rising concerns about reduced refunds or owing taxes, more than a quarter (28%) of Americans say they already spent the money they’re expecting to get back this year. Others plan to spend their anticipated refund to pay off bills (45%), purchase groceries or other essential items for their household (30% ) or go on vacation (19%). A scant 3% plan to save the money in traditional savings, investment, retirement or college accounts.

More than half of Americans say they can’t afford to pay a large tax bill this year (53%). The IRS offers short- and long-term payment plans for qualified individuals who can’t afford to pay their tax bill by the April 18 tax filing date.

Despite the many complexities and headaches that come with tax season, nearly half (47%) of the Americans surveyed complete their own tax returns, while the remaining 53% consult a professional. Those who file taxes believe it saves them money (61%). Others follow the do-it-yourself approach because they have simple tax needs (42%). About one-third are confident they can best maximize their own tax return.

Most taxpayers who consult a professional (53%) to help file tax returns do it with the goal of maximizing their tax refund. People also turn to tax professionals for aid to complete their returns faster (42%) and to get financial advice (36%). About one-third (29%) say they turn to professionals because they don’t know how to complete the tax forms.

For Americans who run small businesses, O’Malley noted, “Half of the CPAs surveyed recommend that small business owners receive professional help with their taxes. And 79% have referred their clients to an online payroll service, a move that centralizes important tax prep documents and saves small business owners time and stress.”

CPAs and bookkeepers advise individuals to seek professional tax prep help when income is above a certain level (53%) or when anyone has any paid job (44%). The CPAs and bookkeepers surveyed include online tax services and large tax-preparation companies (37%) as credible professional options to consider.

Surprisingly, not everyone finds tax time, well, taxing. Some Americans approach the task of filing taxes with anticipation (25%) and hopefulness (23%), sharing it makes them feel productive (23%). CPAs and bookkeepers reported positive feelings about completing their personal tax returns at a higher rate than individual taxpayers. CPAs and bookkeepers say the idea of filing their personal taxes makes them feel productive (43%) and hopeful (33%), filled with anticipation (24%) and excitement (23%).

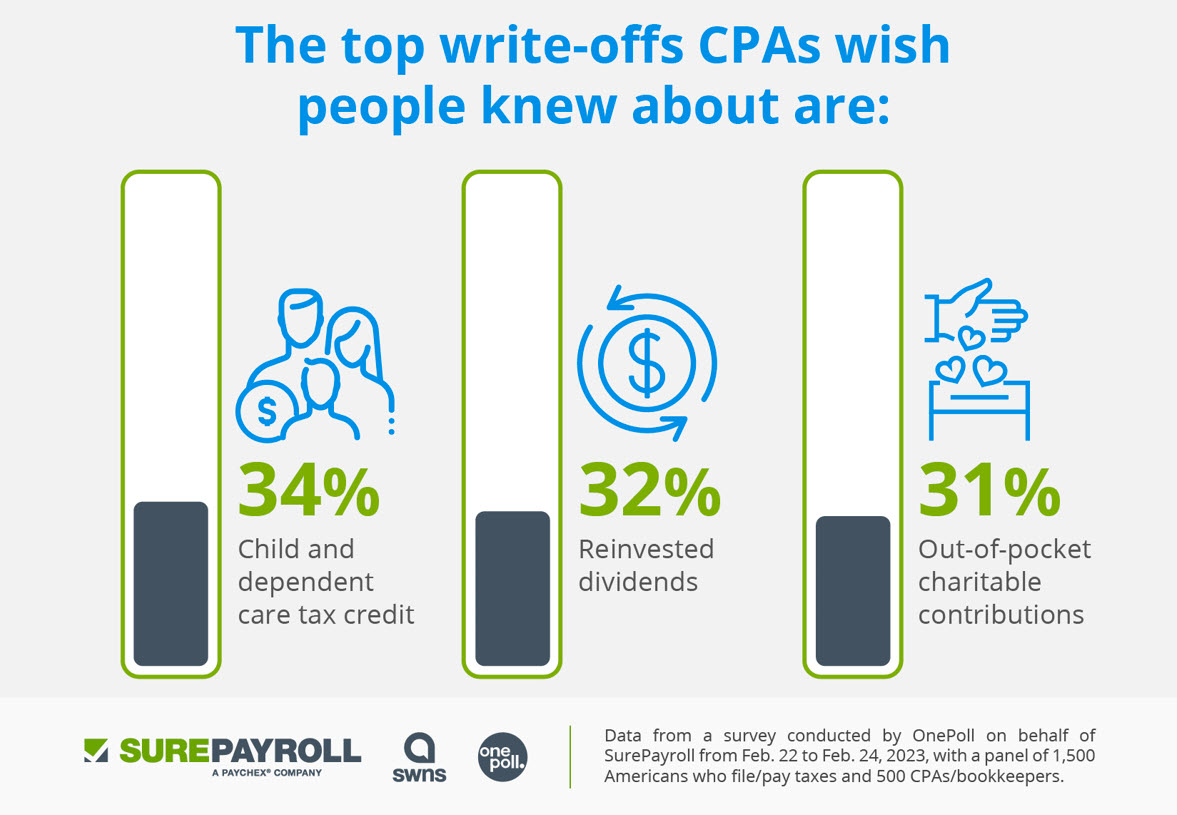

Want more? See the graphic for the top tax write-offs CPAs wish their clients knew.

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.