The Payroll Blog

News, tips, and advice for small business owners

Consumer Survey Signals Potential Warning Signs for Subscription-based Business Model

Subscription businesses have grown considerably faster than the S&P 500 over the last decade, driven by an increase in consumer demand. But a new survey commissioned by SurePayroll suggests there may be warning signs for the subscription business model.

It’s unlikely 15th century cartographers understood the course they charted by selling subscriptions for maps updated with newly discovered lands.

This early exploration expanded across the generations—from newspapers, magazines and milk to books, cassettes and videos to meal kits, pet supplies and clothing—influencing consumer behavior along the way.

Is Favorability for Subscription-based Services Waning?

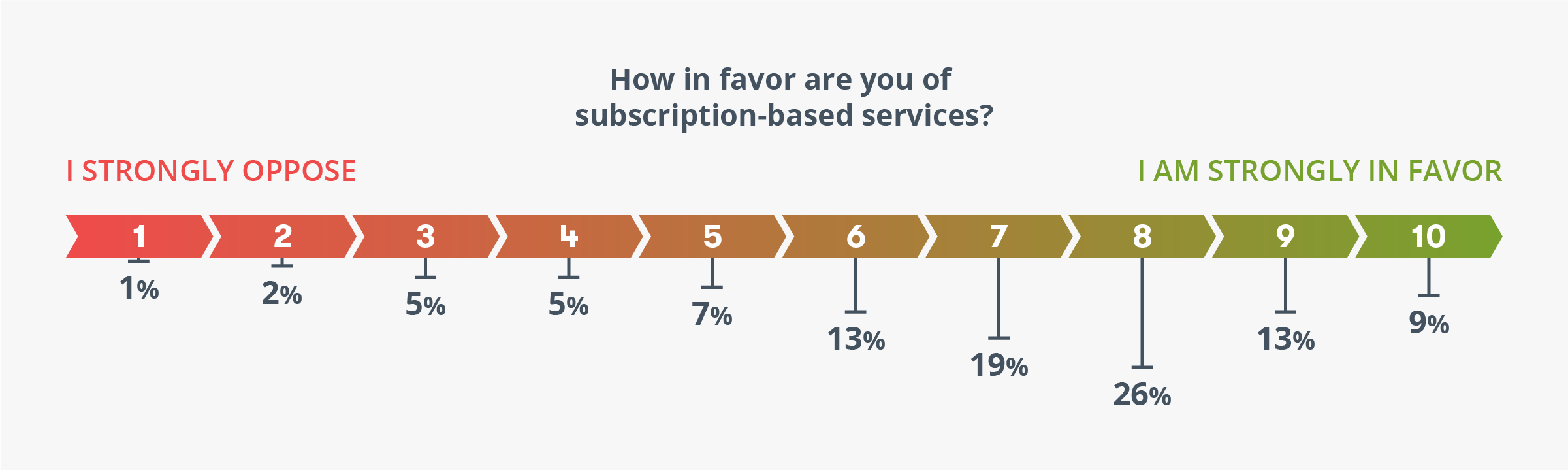

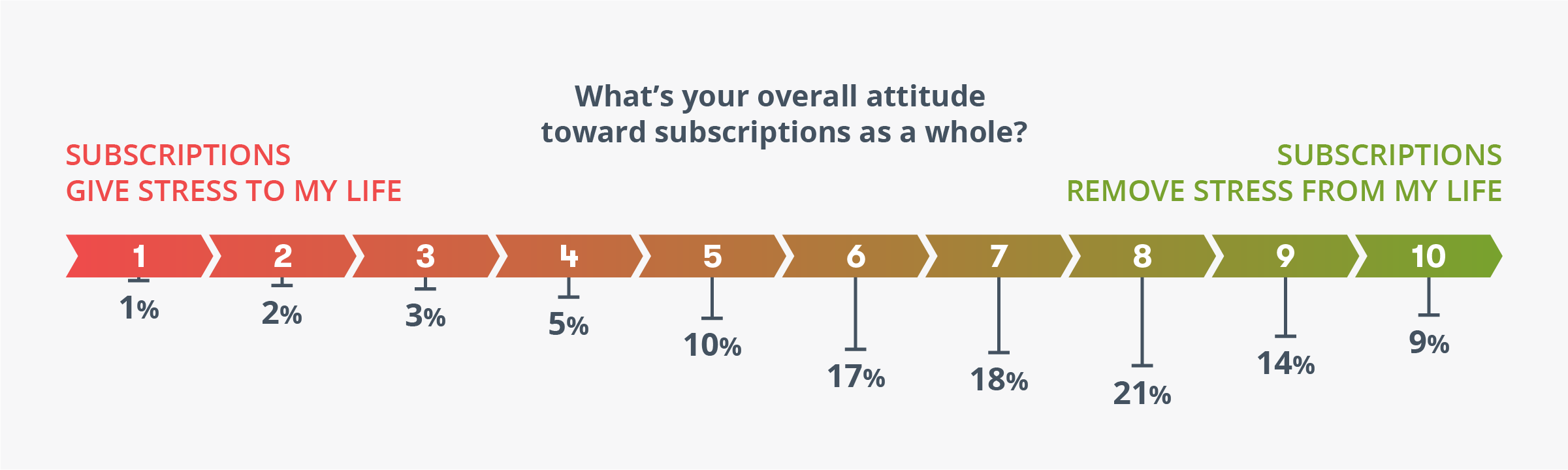

The survey of more than 1,000 U.S.-based consumers shows 95% of respondents believe subscription-based services—purchasing a product or service on a scheduled basis—will become more prominent in the coming years. Yet only 22% strongly favor subscription-based services, with 38% noting subscriptions add versus relieve stress in their life.

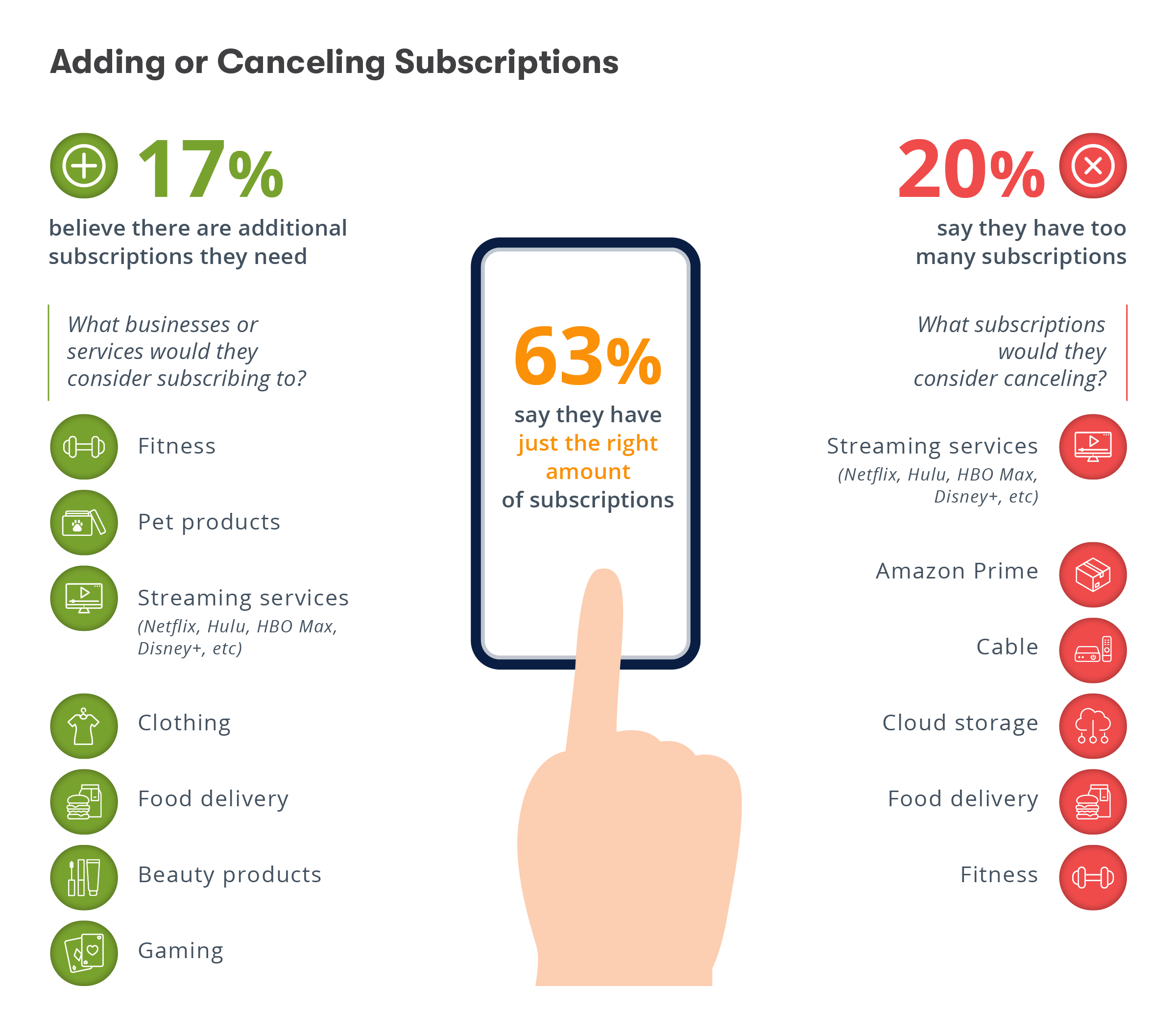

Just 17% of survey respondents believe they need additional subscriptions, while almost two-thirds say they currently have the right number of subscriptions. Interestingly, some of the very subscriptions respondents would like to add—fitness, streaming services, and food delivery—are the same as those who say they have too many services (20%) suggest they would cancel.

The Lure—and Cost—of Convenience

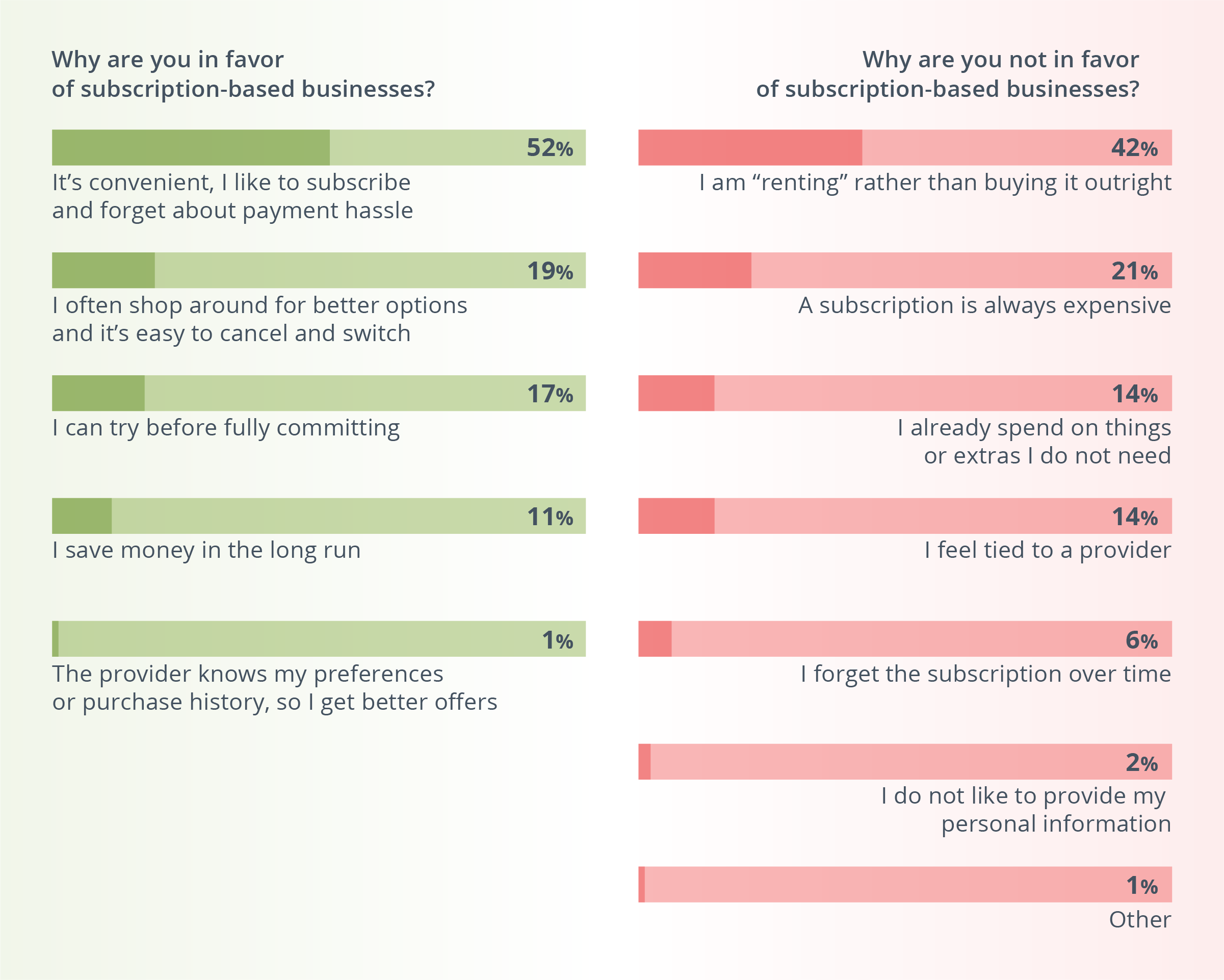

Respondents who favor subscription-based services do so for convenience and the ability to forget about payment hassle (52%). Those who don’t favor a subscription-based business dislike “renting” rather than buying the service outright (42%), along with the expense (21%) or belief they already spend money on too many unnecessary extras (14%).

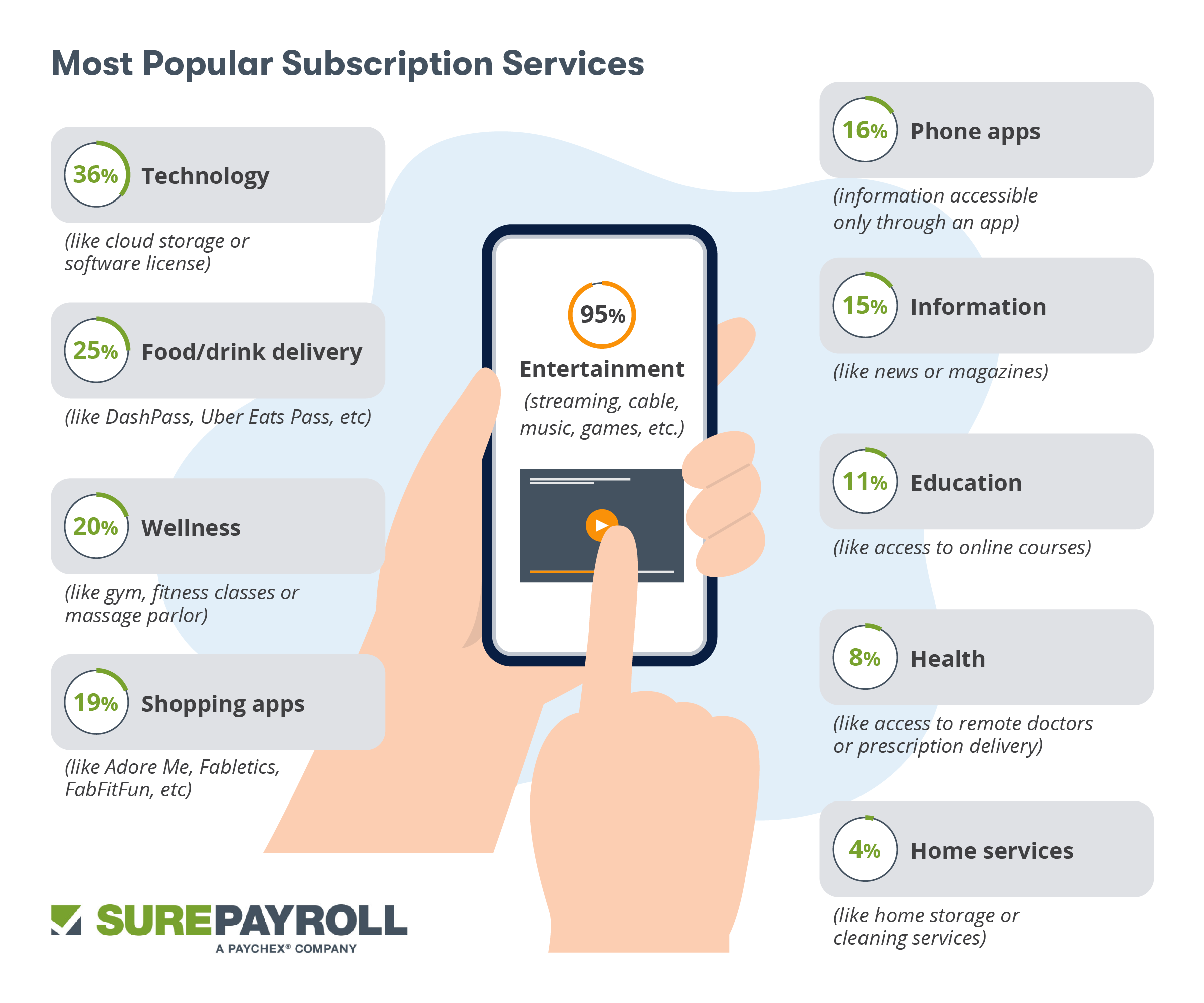

Entertainment subscription services—streaming, cable, music, and games—reign as the most popular subscription services (95%). Technology services like cloud-based storage and software licenses (36%), food / drink delivery (25%) and wellness, which includes gym and fitness classes (20%), round out the most popular services.

Survey respondents report they’re willing to spend $30 per month for a subscription (30%), and roughly one-third (31%) of those with a subscription share or split the payment with someone else.

While telehealth has dramatically increased from a pre-COVID-19 baseline, survey respondents aren’t so sure it’s for them, rating access to remote doctors and prescription delivery services as among the least popular subscription services (8%).

Harnessing Subscription E-commerce Growth

Respondents to the SurePayroll survey say they welcome convenience of a subscription-based service, they also question if the services deliver enough value to justify the added expense.

“Considering one-third of survey respondents oppose using a subscription-based service and e-commerce services tend to attract a younger, urban and more affluent consumer, businesses should build and strengthen relationships with existing customers, and work to broaden reach to additional consumer segments,” said Jason Copeland, SurePayroll General Manager.

Methodology

The July 2022 survey of 1,036 U.S.-based respondents gathered feedback and opinions on subscription-based services or businesses. Respondents were 50% female, 48% male, and 2% non-binary/non-conforming. Respondents had an age range of 18 to 65 and an average age of 25.

When looking at income brackets of respondents, it is broken down as follows: under $20,000: 23%, $20,000 - $40,000: 22%, $40,001 - $60,000: 17%, $60,001 - $80,000: 15%, $80,001 - $100,000: 9%, and $100,001 or over: 14%.

For media inquiries, contact media@digitalthirdcoast.net

Fair Use

When using this data and research, please attribute by linking to this study and citing www.surepayroll.com

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.