The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- What Are Bank Holidays and How Do They Affect Payroll?

What Are Bank Holidays and How Do They Effect Payroll?

From New Year’s to Veteran’s Day, a bank holiday is “a business day during which financial institutions close their doors to the public, and their employees take a day off.”

In short, this means that brick-and-mortar banks are closed, and direct deposits will not be transferred to employee's’ bank accounts. Most of the time, a bank holiday shouldn’t be cause for concern, but if your payroll schedule falls on a bank holiday, employees are going to be upset when they don’t receive their paycheck as planned. Below you’ll learn more about what to do if you encounter a bank holiday and the important dates for 2023.

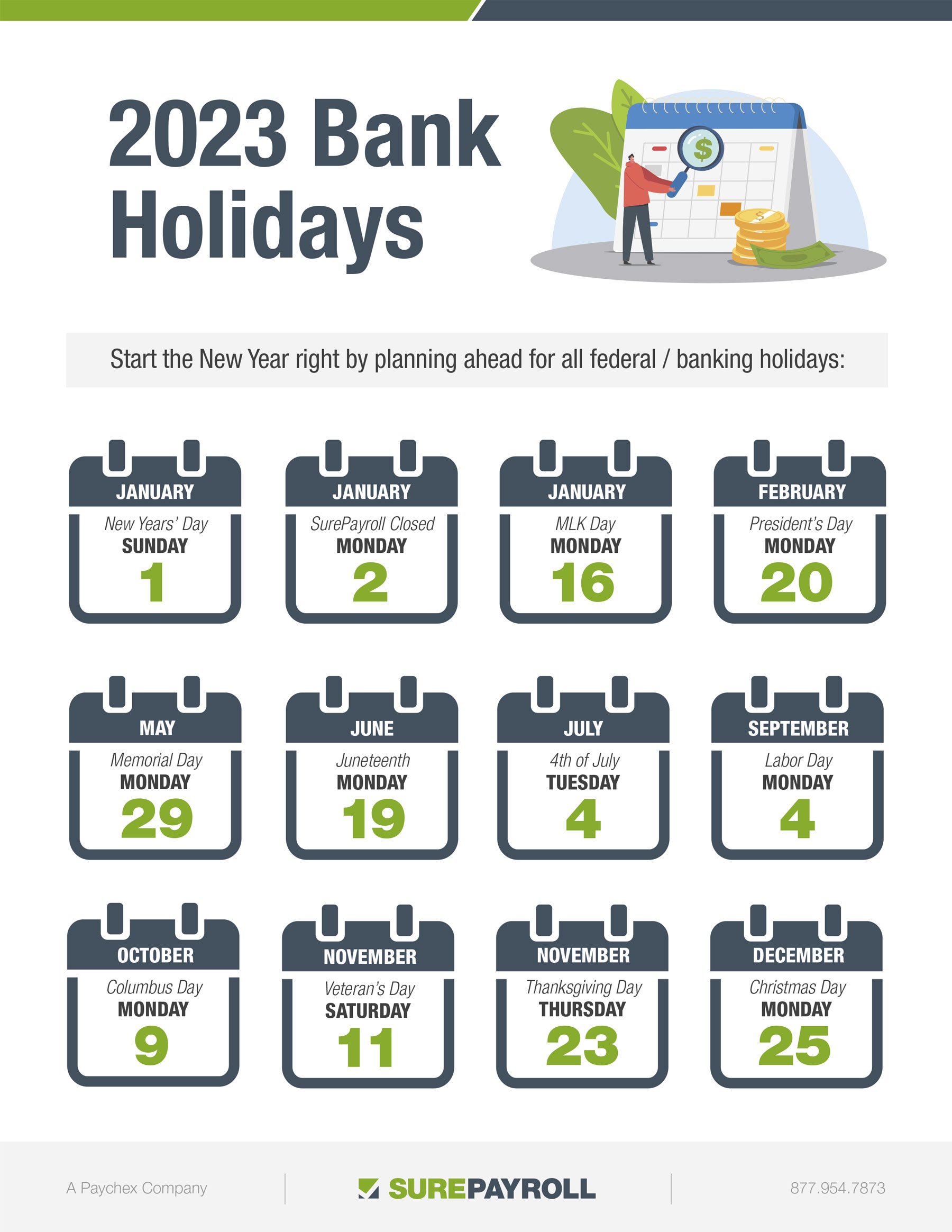

Bank Holidays for 2023

The best way to handle a bank holiday is to be prepared ahead of time. Bank holidays for 2023 are:

How to Handle Bank Holidays and Payroll

If you pay your employees cash, you don’t need to worry about how a bank holiday affects payroll. However, the majority of small business owners are paying employees via direct deposit, and that’s when things can get confusing. When payday falls on one of these bank holidays, you have three choices to make:

- Pay your employees as planned even with the holiday. If you go this route, know that your employees will be paid a day later than normal. Because of this, plan on letting your employees know so they can plan accordingly and not be worried about missing a paycheck.

- Run payroll earlier. To ensure employees are paid before a bank holiday, you will need to run your payroll one business day earlier.

- Expedite the process. If you forget to run payroll earlier but still want your employees to get paid before the holiday, some payroll providers offer flexible payroll options so you can pay to expedite paying your employees. For example, at SurePayroll, we offer same-day and next-day payroll options so you can speed the process up.

While your business may not be affected by all 2023 bank holidays due to your payroll schedule, you should still consider the following tips to be better prepared throughout the year..

- Be consistent. If you go the route of paying your employees before the bank holiday, continue to follow that throughout the entire year. It will make things easier for both you and your employees if they know what to expect.

- Share your payroll schedule. It’s common practice for employers to share the payroll schedule with employees at the beginning of the calendar year. This calendar should note bank holidays and anything else that could affect when your employees get paid.

- Stay organized. If you decide you’re going to pay employees before the holiday, that means you’ll be collecting and inputting timesheets earlier. Make reminders for yourself to ensure that you are doing everything you should ahead of time.

Bank Holidays: The Bottom Line

There’s a good chance that your small business will run into a bank holiday situation at least once during the year. If you want to ensure your employees are paid on time despite these holidays, it’s best to use an online payroll provider like SurePayroll that offers flexible payroll options. To learn more about our same-day payroll feature and other benefits, click here.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.