The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- The Differences Between a Nanny and a Babysitter

The Differences Between a Nanny and a Babysitter

When looking for childcare, you may be confused about the difference between hiring a babysitter and hiring a nanny.

You know that both roles can be available to take care of your children, but do you understand the true differences?

Who is considered a babysitter?

Typically, a babysitter is somebody you schedule for a set period. This could be so you can have a date night, run some errands, or attend a party. You likely make the arrangement by saying how long you’ll be gone and plan to adhere to those times. A babysitter's most important role is to take care of your children. This could be planning activities for them, driving them to activities you have planned, or just hanging out with them in your home. If you want your babysitter to do other activities such as some light cleaning, you can have that conversation with them to make your expectations clear.

Who is considered a nanny?

Alternatively, a nanny tends to be considered somebody you hire to take care of your children full-time. This typically means that your nanny will be watching your children while you work full-time yourself. A nanny also usually has more responsibilities compared to a traditional babysitter, and there are even different types of nannies you’ll want to understand.

- Full-Time Live-Out Nanny: A nanny who works full-time for your family, but does not live in your home. These nannies tend to have many years of experience in child development and child-care which makes them ideal choices for many household employers.

- Full-Time Live-In Nanny: A nanny who, as the title implies, lives in the home of the family he/she works for. The same duties of childcare are expected for a live-in nanny, but the boundaries between work/non-work should be communicated thoroughly. Additionally, compensation usually reflects live-in status.

- Nanny Housekeeper: A nanny who cares for your children, and also performs various housekeeping tasks during childcare downtime. A nanny housekeeper could end up having higher salary expectations because they are performing even more work than other nannies.

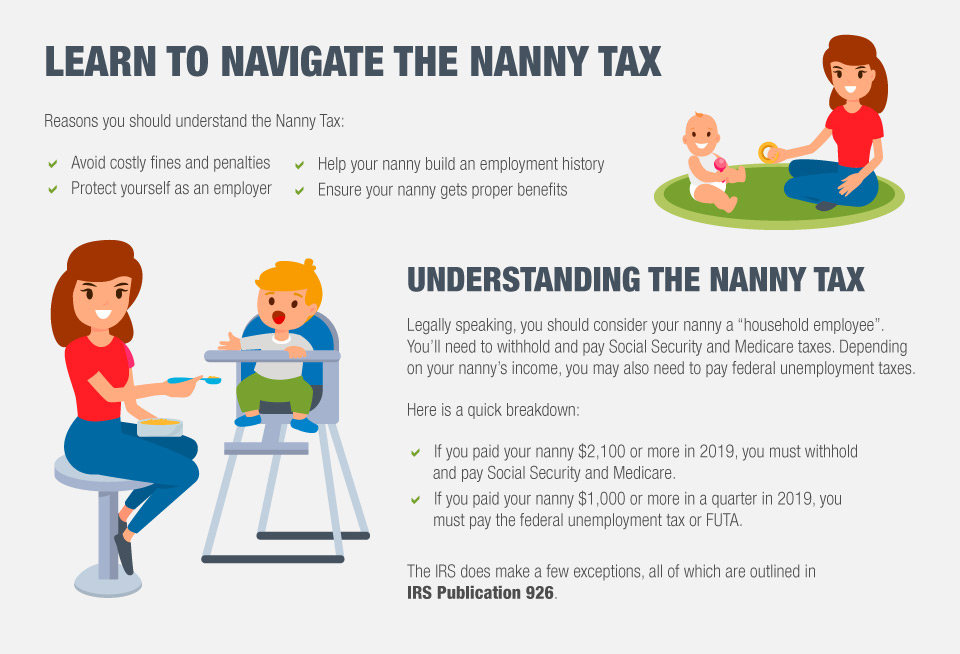

What is the nanny tax?

Outside of the task differences between nannies and babysitters, the key differences come down to how the schedule is dictated, and compensation. While a babysitter is somebody you have a loose arrangement with and only call on as needed basis, a nanny is technically considered a household employee because of their responsibilities, which then makes you a household employer. Being a household employer means you have certain rules to follow when it comes to accurately paying your nanny, which means no cash under the table.

If you still have questions about what the nanny tax is, forms you need to know about and any exceptions, be sure to check out our Guide to Nanny Taxes.

Bottom Line

While you may use the terms of babysitters and nannies interchangeably, they are two distinct roles. When considering the needs you have for your household, make sure you fully understand what you are looking for and how to pay your new employee accurately. If you’re not sure how to manage payroll on your own, choosing an online payroll software can be extremely beneficial. Just be sure to research each company because not all payroll software is created the same. Specifically, when it comes to nanny payroll, we offer three things for nanny payroll that competitors may not, and they are things that you’ll want to have included.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.