The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- What Clients Want from an Accountant

Bridging the Gap: What Clients Want from an Accountant

Certified Public Accountants (CPAs) and their clients generally share a symbiotic relationship, one where communication and transparency are key.

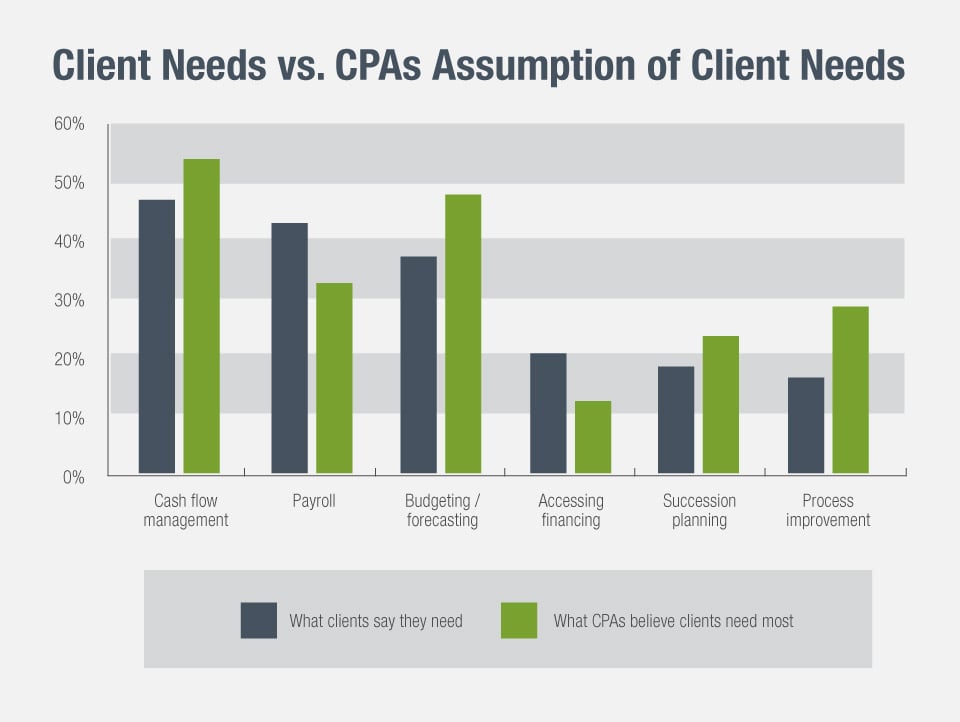

However, there can be a bit of a disconnect when it comes to what clients may be looking for in an accountant, versus what the accountant may think they need to be offering.

According to a recent survey conducted by SourceMedia, approximately half of small business owners consulted an accountant in 2018, with most seeking out tax and bookkeeping services. Additionally, 26% of survey respondents that were not currently using an accountant noted that they were somewhat or very likely to make use of an accountant in the upcoming year. Knowing that so many accountants are offering the same types of services, how can you, as an accountant, position yourself to make sure you’re offering what your client wants?

Accounting firms say their clients stated a strong desire for services like cash flow management, payroll services, and budgeting and forecasting. Other services they saw a need for included assistance with accessing financing, succession planning, and overall process improvement. While some of these services are typical to an accountant, offering additional services may give well-rounded CPAs and accounting firms an advantage and help you secure the ‘trusted advisor’ status that may give you an edge over the competition.

What Clients Say They Need:

Payroll

Payroll, a task that is mandatory for any business that hires employees, can often feel like a necessary evil. Interestingly, the SourceMedia survey found that while 43% of small business owners stated a need for assistance with payroll services, just over 30% of accountants thought payroll was a needed service for their client. However, instead of seizing on this opportunity, nearly 60% of accountants wait for their clients to broach the subject before offering the service. The survey also revealed that nearly 90% of accounting professionals stated that they were ‘not very likely’ or ‘not at all likely’ to start offering payroll as a service, which means there is a huge gap in people needing payroll services and accountants who are willing to offer it.

From an accountant perspective, providing payroll is considered a thankless job, as it requires a lot of time with little benefit to the provider. However, with the introduction of online payroll, payroll for accountants has never been simpler or more secure. With SurePayroll’s Reseller Program, Accountants can easily control their client’s payroll in a centralized platform and review and approve payroll with a few easy clicks. Additionally, SurePayroll’s services are backed by our 100% tax filing guarantee*, meaning if there is an issue with your filing, SurePayroll will work to resolve the issue on your client’s behalf and pay any associated fines if we’re found to be at fault. Offering a payroll solution in addition to your existing suite of services may increase your business since you will be offering a ‘sticky’ service that other accountants may not be willing to provide.

Accessing Financing

While small business owners likely have a stash of capital ready in hand when they look to open or expand their businesses, many need help accessing financing to fund these big moves. Survey respondents noted that more clients felt that they could use their accountant’s assistance with accessing financing, while many CPAs felt it was less of a need.

As an accountant, you likely have a unique perspective on what sort of financing your client could take advantage of. And while your client may not require an accountant to access those funds or apply for a loan, it could be something that helps solidify your status as a trusted advisor to them, rather than just someone who keeps the books.

What CPAs Think Their Clients Need:

Cash Flow Management

Cash flow management is important for any business, but for a small business, it can be the difference between boom or bust. CPAs generally believe that clients need assistance with their cash flow, often more than the client does. This could be because CPAs have more experience with what can happen when a business does not have the capital needed in a time of crisis. While all small businesses should have a little extra capital on the side for emergencies, many find they must dip into those savings earlier than expected to keep their business afloat and fall short during a true time of need. Having a third-party resource to help manage finances can be critical for any small business, especially during the start-up process.

Budgeting/Forecasting

Similar to cash flow management, budgeting and forecasting can make or break a business. Forecasting, in particular, focuses on analyzing historical data to help guide future decisions, so it helps detect cyclical patterns that can help your clients avoid a sticky situation. According to SourceMedia, CPAs generally feel that a significant number of their clients would benefit from an accountant’s assistance with budgeting and forecasting. As an accountant, you know the importance of forecasting and budgeting, even if your client may not. CPA, Matthew Weissman, said he sees so many businesses close their doors because they didn’t have the cash to sustain their business plans. When small business owners have an accountant to help them out, they can avoid closing early by getting guidance on what to do with their money.

Succession Planning

Often, succession planning is a critically overlooked element of small businesses. A small business owner may be more concerned and occupied with the success of their business day-to-day so they may not be thinking as much about the future or what may happen after they retire. Without a solid succession plan, small businesses can fall apart when an owner or partner retires, and there isn’t a clear set of plans on how to move forward. As an accountant or trusted advisor, you may be able to offer your clients a service that could influence the success of their business long-term, rather than simply keeping them going for the short-term. Showing your clients that you are invested in their business’ success is a sure-fire way to gain their loyalty and help secure your status as a trusted advisor.

Process Improvement

While a small business owner may think they have the details of running their business ironed out, as an accountant, you may have better insights into an ideal process plan. The SourceMedia Survey showed that CPAs felt that their clients could use assistance with process improvement, even if clients themselves didn’t agree. Keeping track of things like inventory, payroll, taxes, accounts payable and receivable, and HR processes may be too much for the typical small business owner, and accountants know the risks associated with these tasks can be enough to topple a young small business. By offering tips on how to streamline your client’s small business, you can help them avoid common mistakes that could hurt their efficiency and profit margins.

The Bottom Line

If this survey is any indicator, there are plenty of opportunities for accountants to grow their business by expanding their offerings to more than just bookkeeping and tax assistance. By really listening to your clients’ needs and offering custom solutions, you’ll set yourself above the competition and show your client that you are invested in their long-term success, as opposed to thinking of them as just another name on your roster.

Not sure where to start? Take a look at SurePayroll’s Reseller program and see if we can help you offer your clients more, without giving you extra work!

*If you receive a notice from the IRS, or any other tax agency, based on a filing that SurePayroll made for your organization, we’ll work with the agency to help resolve the issue on your behalf. And, if we’re at fault, we’ll pay all the associated penalties and fines.

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.