The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- The Top Small Business Tax Pitfalls

Avoiding the Top Small Business Tax Pitfalls

While opening a new small business is an exciting journey, payroll and taxes are undoubtedly less so. Because this is an area that many small business owners don’t initially think about when opening their new business, it’s easy to make tax mistakes.

While many payroll and tax mistakes do have a fix and you can get help resolving any errors, some of these mistakes can be costly so you’ll want to try to avoid as many as possible early on. Below you’ll learn about some of the top tax pitfalls and tips on how to avoid them.

Combining Personal and Business Finances

When running a small business, it’s might seem easier to keep all of your money together and blend personal and business finances. While this may seem harmless, the merging of funds can make tracking cash flow and filing taxes harder than it needs to be. Additionally, when everything is combined, mistakes happening at your business could negatively impact personal finances and vice versa. To avoid this pitfall, start by setting up separate bank accounts; have one for personal finances and one for business finances. Next, if you haven’t already done so, you’ll want to choose a legal structure for your business. The formal legal structure will help with finances, but it will also make preparing for tax season easier because you’ll know which expenses are related to your business.

Misclassifying Employees

When first hiring employees, you might just be focused on what their job responsibilities include and whether they will be full-time or part-time. However, for payroll and tax purposes, it’s important to classify your employees properly to ensure they are being paid accurately as exempt or non-exempt from the Fair Labor Standards Act and state wage and hour laws. In its simplest form, a non-exempt employee is entitled to overtime pay at a rate of one and one-half times their regular rate of pay for hours worked over 40 in a workweek. If you classify an employee as exempt when they should be non-exempt and fail to pay them the appropriate overtime pay under federal and state law, you will be liable for the back overtime wages and the applicable taxes on those wages. Penalties may also apply.

In addition to exempt and non-exempt, you need to consider whether you’re distributing Form W-2 or Form 1099 to workers, meaning who is an employee and who has been accurately classified as an independent contractor, sometimes referred to as a freelancer. There are definitions under applicable laws for employees and independent contractors. For employees, you’ll distribute Form W-2 for tax filing purposes. And for Independent contractors, you will issue a 1099 form. Taxes will vary for each group of workers, so you’ll want to ensure you’re classifying correctly under all applicable laws.

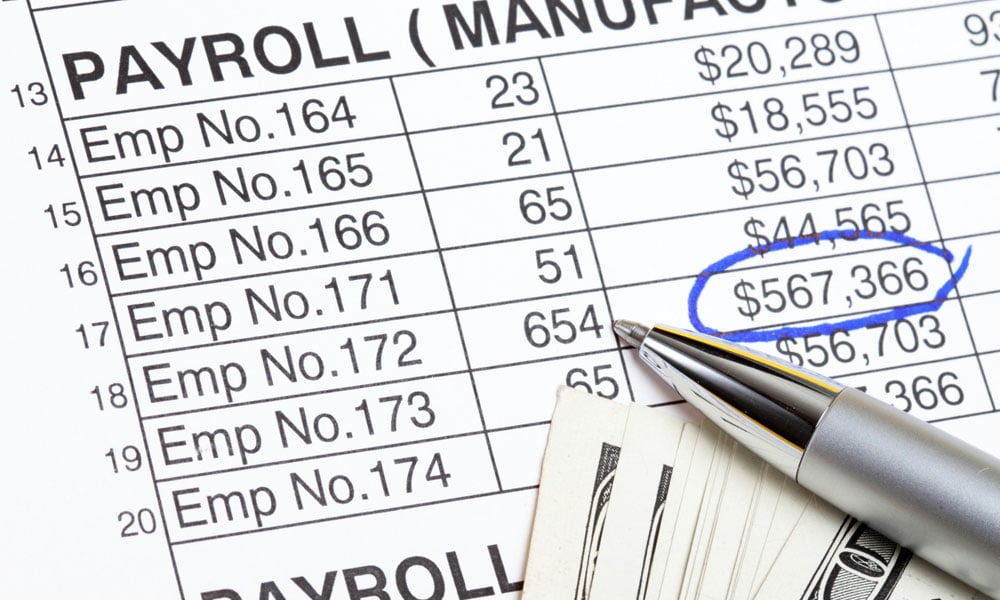

Failing to Understand Payroll Taxes

As we teased above, there are payroll taxes that you need to be aware of. When preparing paychecks for your employees, you are responsible for withholding income tax, and Social Security and Medicare taxes. You’ll know how much to withhold according to your employee’s Form W-4. Next, you are responsible for paying unemployment taxes under the Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA). When you withhold incorrect amounts or fail to pay these taxes, you could run the risk of an audit from the government.

Failing to Prepare for Filing Taxes and Tax Season

While people get excited for other seasons throughout the year, the one that does not spark the same amount of joy is tax season. Tax season kicks off at the beginning of each calendar year and ends on the April 15th personal tax filing deadline. For small business owners, it’s a busy time with ensuring employees have the forms they need to meet this filing deadline, but business owners also need time to prepare. Additionally, depending on the type of business you run, you may be required to pay estimated quarterly taxes. To understand if these taxes impact your business, the IRS website has the information you need.

Because a lot needs to happen in the four-month tax season window, it helps to prepare throughout the year. Did you know there are many tax deductions available to small business owners? By not submitting for deductions, you’re closing the door on the opportunity to potentially lower what you owe in taxes. Keep track of receipts throughout the year and store any important documents in a safe place. If you work with an accountant or bookkeeper regularly, they can help you prepare and ensure that you’re ready to go when tax season hits.

Bottom Line

Taxes are a constant aspect of life, but navigating them as a small business owner can be overwhelming. The best thing you can do to avoid these common tax pitfalls is to educate yourself on the tax laws for your state or seek help from a trusted source like an accountant or bookkeeper or an online payroll service.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.